Malaysia’s bustling healthcare market

Prime Minister Dato Seri Anwar Ibrahim recently shared that Malaysia must prioritize investments in critical sectors, especially towards healthcare, as Malaysia is becoming a rapidly ageing society. It is anticipated that the elderly people will account for 14 per cent of Malaysia’s population. With government support and private sector collaborations, the country’s healthcare industry has improved over time with technological advancements in its infrastructure and healthcare services. It has also become an avenue for Malaysia to penetrate the global healthcare market. The first quarter of 2024 saw a staggering 353,000 medical tourists, with the medical devices sector and pharmaceutical segment seen jointly contributing USD 5.45 billion to the country’s GDP this year.

It is important to note that government spending has positive spillover effects on the healthcare sector. Based on Malaysia’s 2024 budget, the healthcare sector received MYR 41.22 billion (USD 9.41 billion), higher than MYR 36.3 billion (USD 8.29 billion) last year. The increased allocation creates opportunities for the development of healthcare products, equipment, and services required for hospitals and clinics. For instance, a bigger budget for this sector means free radiotherapy and radiosurgery treatments, distribution of medicines to citizens, and additional supplies of medical equipment and consumables for the public.

Graph 1 shows that trade volumes of shares under Bursa Malaysia’s healthcare sub-index have been volatile in 2024, peaking in May before falling by one-third in June. In contrast, there is a clear upward trend in share prices, rising by nearly 18 per cent from 1,961.99 at end-January to 2,308.03 by December. Although the trajectories of stock volumes and adjusted closing prices vary, the local healthcare sector remains attractive for new investments as share prices are likely to maintain their ascent in the coming years, while international demand for Malaysia’s healthcare industry will grow in terms of demand for services and manufactured goods.

Meeting demands, seeking potential

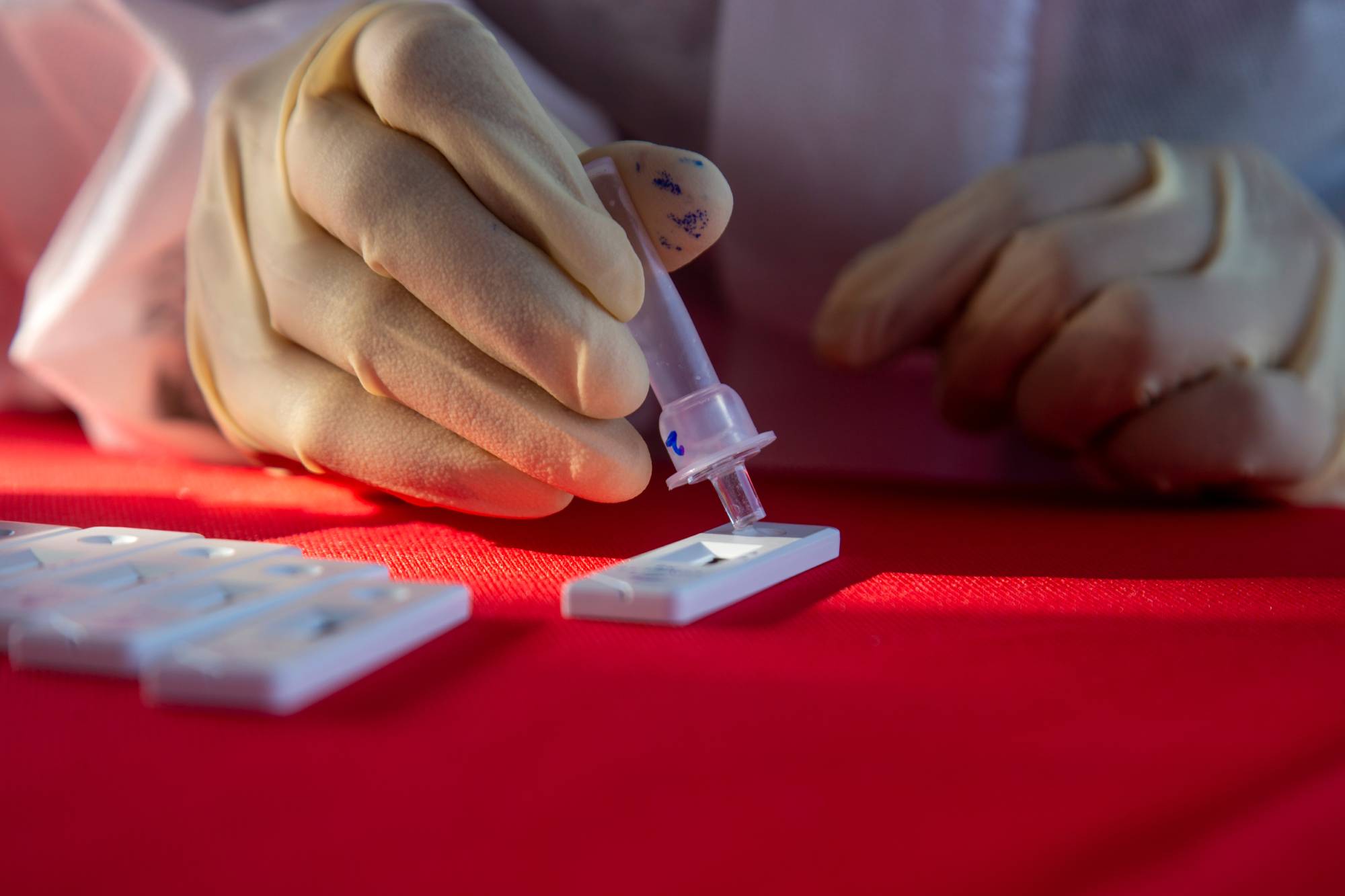

One market that can gain from increased public spending on healthcare is the medical devices market, especially as the government is prioritising domestic medical devices production under its National Industrial Master Plan 2030 (NIMP 2030). According to Sivasuriyamoorthy Sundara Raja, deputy chief executive officer of Investment Promotion and Facilitation of the Malaysian Investment Development Authority (MIDA), the rising number of patients diagnosed with chronic diseases highlights the need for early diagnosis and treatment. This drives the increasing demand for medical devices in the domestic market.

With the NIMP 2030 in motion along with the production of high-tech medical devices like pacemakers, patient monitors, and diagnostic equipment, the medical devices market value in Malaysia is expected to reach USD 4.5 billion by 2028. Additionally, the Malaysia External Trade Development Corporation (MATRADE) expects that the country’s medical devices sector will contribute USD 4.19 billion to the economy this year. The MATRADE believes that Malaysia remains to be the largest market for medical devices within ASEAN, and that its participation in free trade agreements fortifies its position in the healthcare industry.

If we look at total investments towards medical devices production between 2019 to 2023, the combined amount would be MYR 24.674 billion (USD 5.64 billion). As illustrated in Graph 2, cumulative annual investments fluctuated after 2021, although foreign investments peaked in 2022 as it reached MYR 4.5 billion (USD 1.03 billion). To sustain inward investments for this sector, the government is encouraging investors through tax incentives for research and development and through the automation capital allowance, which provides tax breaks to companies that invest in automation machinery to improve factory efficiency.

Despite the challenges faced by Malaysia in terms of attracting additional investments in the healthcare segment, this sector is growing steadily – albeit an effect of the country becoming an ageing society, which is pushing the need for greater health-seeking behaviour and chronic disease prevention. We believe that medical technologies will continue to evolve, powered in part by the integration of artificial intelligence systems in the delivery of health services.

In terms of healthcare services, two potential segments are growing in Malaysia: medical tourism and the care economy.

According to the Malaysia Healthcare Travel Council, Malaysia’s medical tourism sector generated a revenue of MYR 577 million (USD 131.8 million) in January-March, which is 18 per cent higher than the MYR 490 million (USD 111.9 million) revenues from the same quarter of 2023. With increased activity in medical tourism, the sector is expected to contribute an economic spillover of MYR 9.6 billion (USD 2.19 billion) to other industries. MIDA’s Malaysia Investment Performance Report 2023 also shows that Malaysia’s healthcare industry is becoming more attractive due to its affordability, shorter waiting times, and availability of specialized medical expertise. Foreign patients, especially those from developed countries, seek treatment in emerging economies like Malaysia where the healthcare system is largely regulated, which provides assurance regarding quality and efficacy. Costs are generally lower, and in some cases, allow patients to benefit greatly from exchange rate adjustments.

The increasing popularity of medical tourism has also contributed to greater demand for medical devices in Malaysia.

Meanwhile, Deputy Minister of Economy Hanifah Hajar Taib stated that the caregiver economy is flourishing in Southeast Asia and has the potential to reach a value of MYR 114.2 billion (USD 25.5 billion). This includes opportunities in the healthcare industry and long-term care tourism, as well as accessibility of medical supplies and advanced medical technologies.

Sustaining the growth of the care economy and the expansion of the domestic production of medical devices will enhance the ability of Malaysia’s elderly to seek medical care while adding value to the overall economy. In particular, we see strong investment potential in the logistics and robotics businesses as these would improve the productivity and quality of healthcare devices and services in Malaysia.

This original article has been produced in-house for Lundgreen’s Investor Insights by on-the-ground contributors of the region. The insight provided is informed with accurate data from reliable sources and has gone through various processes to ensure that the information upholds the integrity and values of the Lundgreen’s brand.