When neglect triggers unrest: ASEAN's uprising

Protests have spread like wildfire across economies in Asia as civil unrest over bad governance, corruption, and high cost of living is escalating.

global-quarterly-q4-2025

Protests have spread like wildfire across economies in Asia as civil unrest over bad governance, corruption, and high cost of living is escalating.

On behalf of our team at Lundgreen’s Investor Insights, we wish you a happy holidays!

With subsidies expiring, core prices climbing, and the Bank of Japan hesitating to tighten rates, investors must now navigate an economy where both policy and price dynamics are shifting all at once.

India must tread carefully as it navigates a balance between geopolitical relations with the US and China, which has been soured by its entanglements with Russia.

State-owned Chinese firms carry the heavier burden of keeping the country’s manufacturing sector on high growth mode. Is this sustainable?

Greece is repaying its debt ahead of schedule and Italy is getting upgraded by Moody’s. Meanwhile, France lost another rating nudge and Germany’s economy remains frozen. It looks like the future in the Eurozone is somewhere else than it used to be.

While increasing debt levels are reason to look closer at government finances, missing public investment is the real danger in the years to come.

The Bank of England cut its key interest rates despite inflation steadily creeping up. Its optimism seems to be paying off, but it is too early to be relieved.

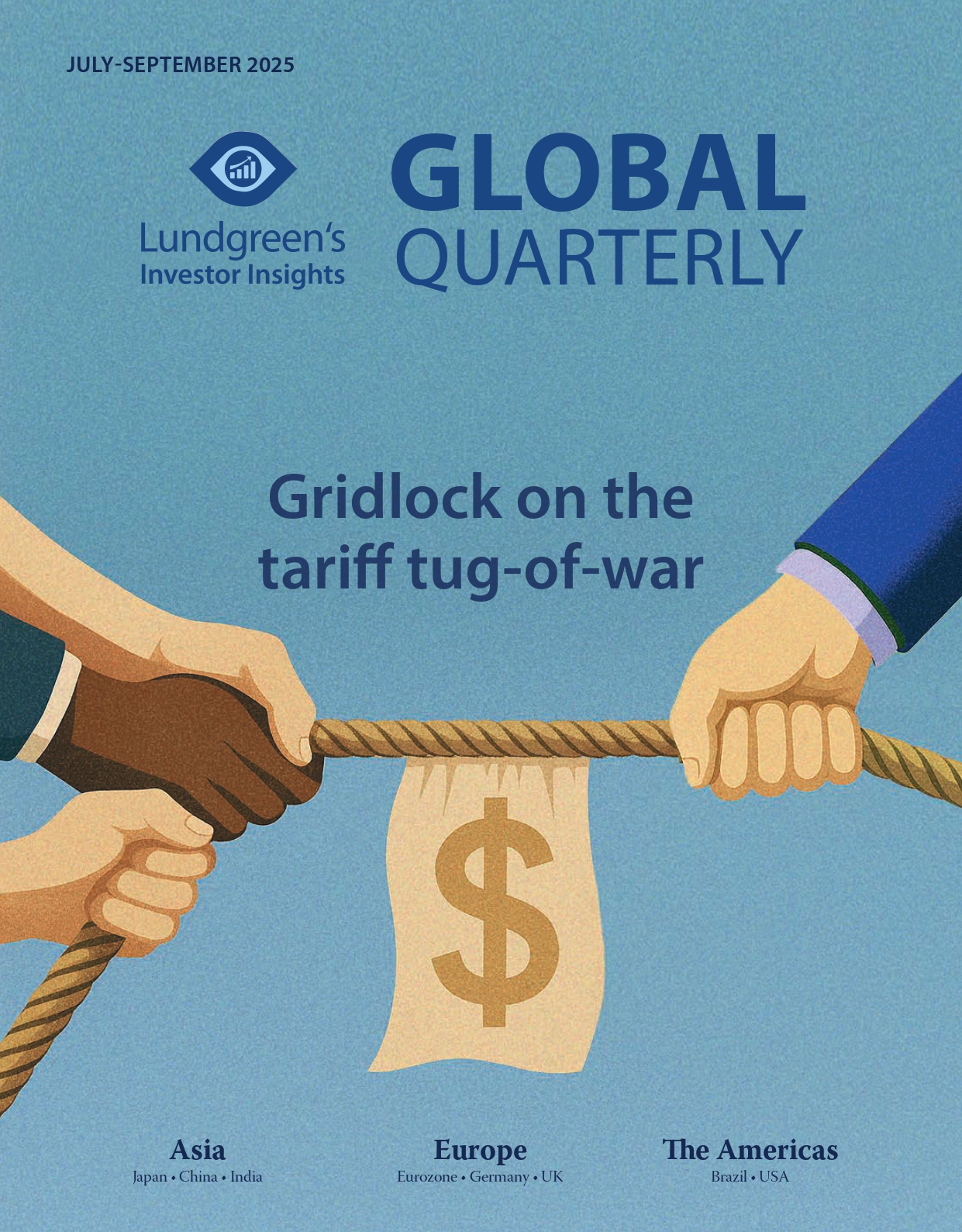

Trump is doubling down political pressure on Brazil to get what he wants, at the cost of trade flows between the two nations.

US stocks beat expectations and notched multiple record highs in 2025, overcoming the odds amid a slowing economy and an increasingly squeezed consumer base. Will this trend hold next year?